Donation Receipt

Donation Receipt

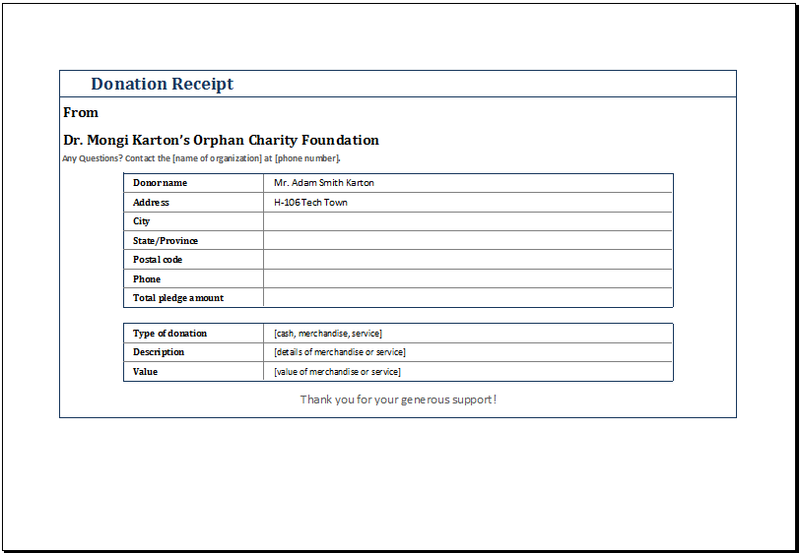

A donation receipt needs to have precise information concerning the exact value of the donation as well as what the donor got in return.

latest release: 2024-03-21 13:40:46

Description

It is important to write the name of your particular charity. You also need to state that you are precisely a non-profit entity. The donor’s name has to be on the receipt. In this way it becomes valid. You have to write the date of the donation plus how much was given. The donation may not be in cash, if so, and then write a description of what it was. The receipt needs to be signed precisely from someone who is in the organization. You need to keep a copy of this receipt. You can find donation receipt templates online.

Additional documentation: http://www.xltemplates.org/cash-or-funds-donation-receipt/

Homepage: http://www.xltemplates.org/cash-or-funds-donation-receipt/

Release List

Charitable donations tend to be tax-deductible for the particular donor plus reportable by the specific nonprofit organization, therefore a donation receipt needs to have precise information concerning the exact value of the donation as well as what the donor got in return. It is easy to make a donation receipt by hand as well as on your computer. This article will tell you how to make invoices such as billing statement invoice and other invoice templates.

Download

☆ ☆ ☆ ☆ ☆

Post your review

You cannot post reviews until you have logged in. Login Here.

Reviews

No one has commented on this page yet.

RSS feed for reviews on this page | RSS feed for all reviews